How shifting from dictionary keywords to local slang unlocked top rankings in 7 days.

- Overview:

- The Challenge: Competing in a Closed Ecosystem

- Our Strategic Approach

- Keyword Promotion Campaign Execution

- Results and Strategic Analysis

- Conclusion

The South Korean mobile market presents a unique paradox for international developers. It offers massive revenue potential and incredibly high user engagement, yet remains one of the most difficult regions to enter due to deep linguistic and cultural barriers. Many apps are published, but few survive local competition. So, how do you bridge the gap between being an outsider and becoming a market leader?

In this case study, we break down exactly how a social chat app went from near invisibility (Rank #150+) to dominating its niche in just seven days. The turning point wasn’t a technical update or a massive ad budget. Instead, it was a strategic shift in App Store Optimization (ASO), moving from formal translations to “native” slang, accelerated by a precision keyword install campaign.

The Challenge: Competing in a Closed Ecosystem

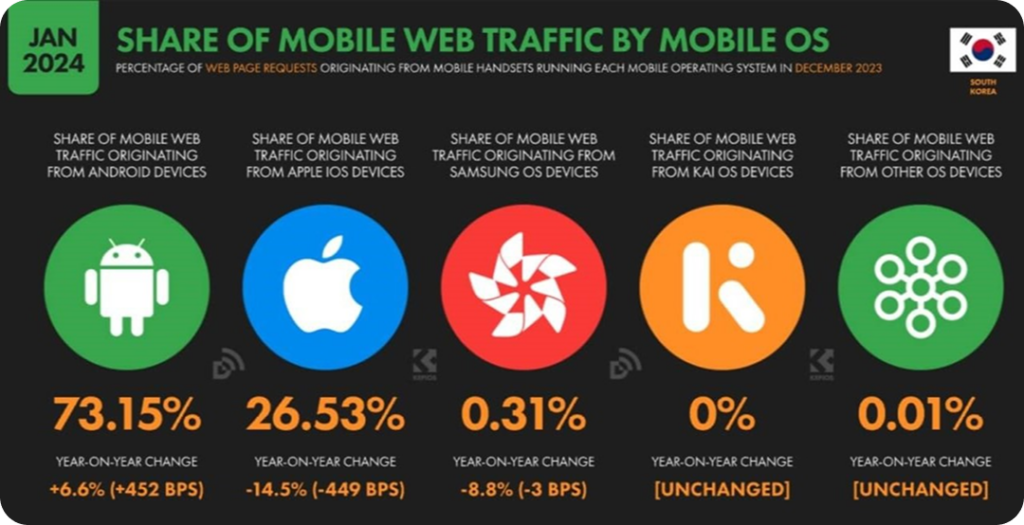

To understand the app’s initial struggle, we first need to look at the battlefield. South Korea predominantly uses Android devices, accounting for 73.15% of mobile web traffic compared to 26.53% for iOS. However, visibility in the South Korean Google Play Store is not determined solely by ad spend or general functionality. It is determined by cultural fit.

Our client, a social networking app designed for digital companionship, entered this high-stakes environment with a technically sound product that was fully translated into Korean. Yet, three weeks post-launch, organic traffic was non-existent.

The app was trapped by two specific barriers:

- The “Super-App” Monopoly. Local giants like KakaoTalk and Karrot set the user experience standard. To break through, a new entrant must offer immediate, specific value, like anonymity or hyper-local chatting, that these all-encompassing platforms don’t cover.

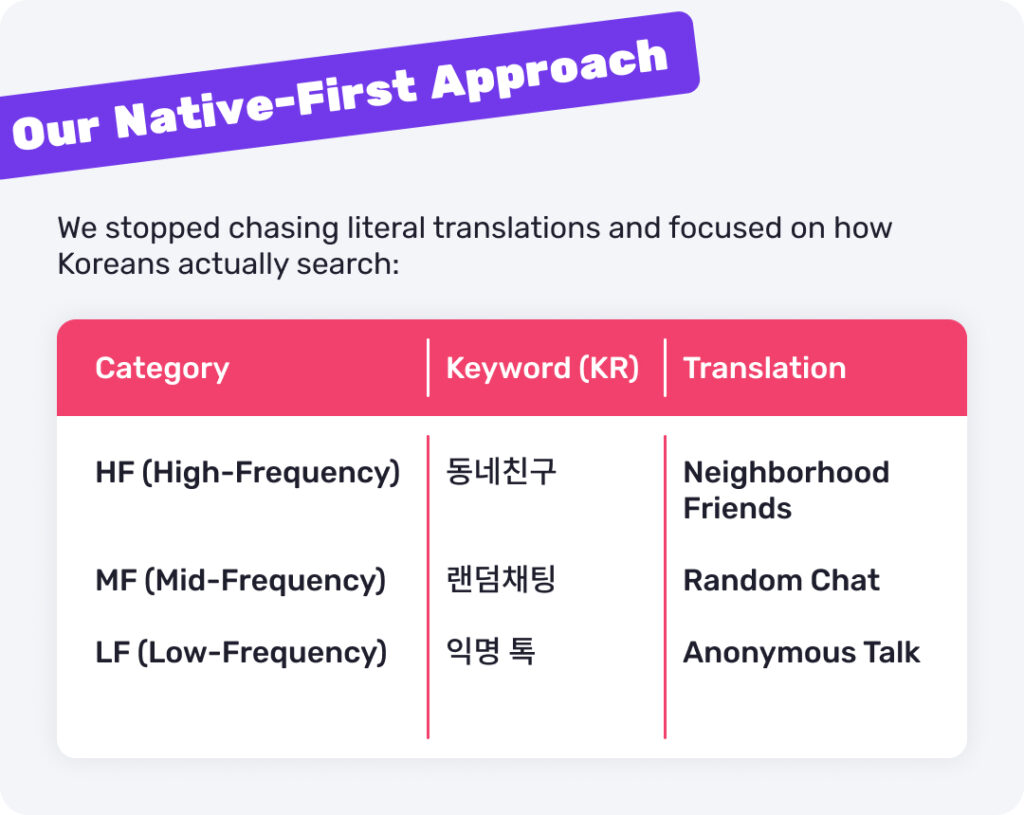

- The “Dictionary” Trap. The initial ASO strategy relied on standard, formal translations. The metadata used grammatically correct terms for “talking,” while the target audience (Gen Z) was searching for specific slang implying casual, immediate “vibes.”

Because the keywords didn’t match the actual search intent of local users, the app languished below Rank #150. In mobile marketing, where visibility effectively ends after the top 20, the app was invisible.

Our Strategic Approach

To break through the noise, we needed to signal to the Google Play algorithm that this app was highly relevant for the specific keywords native users were actually typing. We restructured the metadata and built a keyword promotion campaign around three tiers of keywords, shifting from formal language to “native” speech.

Keyword Promotion Campaign Execution

We executed a 7-day campaign using our Keyapp.top platform. The strategy was to show natural organic growth. We used a progressive scaling model, increasing daily volumes to match the app’s improving rank. Below is the breakdown of the execution for each keyword tier.

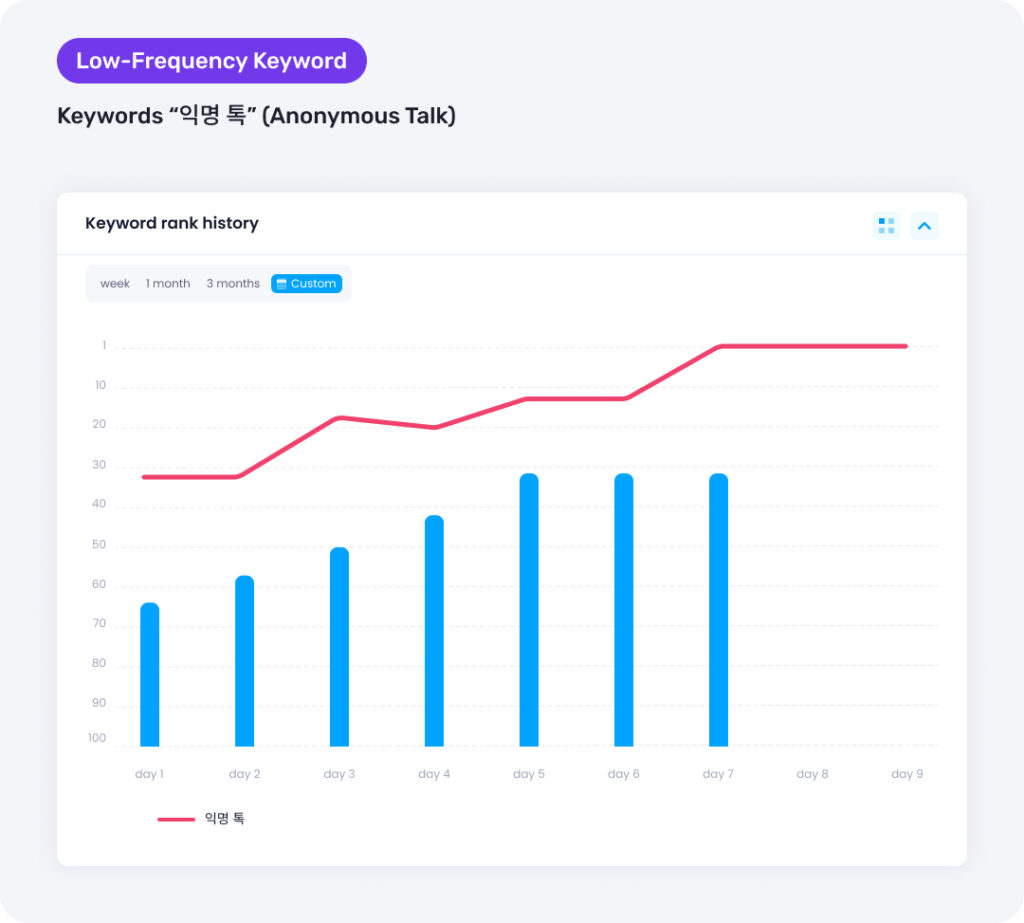

1. “Anonymous Talk” (익명 톡). We launched the campaign focusing on the long-tail keyword “Anonymous Talk,” starting from rank #32. Success with niche terms relies on consistency rather than high volume, so we avoided aggressive spikes. The goal was to gently nudge the algorithm with steady engagement.

In the first two days, we delivered only 15 to 25 installs daily. This small amount was sufficient to signal relevance. By Day 3, the app had already climbed into the Top 10. To support this growth and push toward the Top 5, we raised the volume to 40-50 daily installs.

For the final three days, we increased the volume slightly to 60 installs per day. This ensured we could lock in the #1 spot and defend it against any ranking volatility. The app successfully reached Rank #1 by Day 6, establishing the necessary domain authority to tackle more competitive keywords.

2. “Random Chat” (랜덤채팅). Our second target was the mid-frequency keyword. The app started at Rank #65. This position is difficult because users rarely scroll down to the third page of search results.

During Days 1 and 2, we delivered between 30 and 45 installs daily. This initial push successfully moved the app from Page 3 to Page 2. By Days 3 and 4, we scaled the volume to 65-80 installs per day. This increased velocity helped the app break into the Top 10. Finally, for Days 5 through 7, we held steady at 95 installs per day. The goal was to stabilize the ranking and secure a Top 5 position.

The plan succeeded, and the app finished at Rank #4. This position is critical because users searching for “Random Chat” typically download the top two or three results to compare them. Being at Rank #4 allowed the client to capture this high-intent organic traffic.

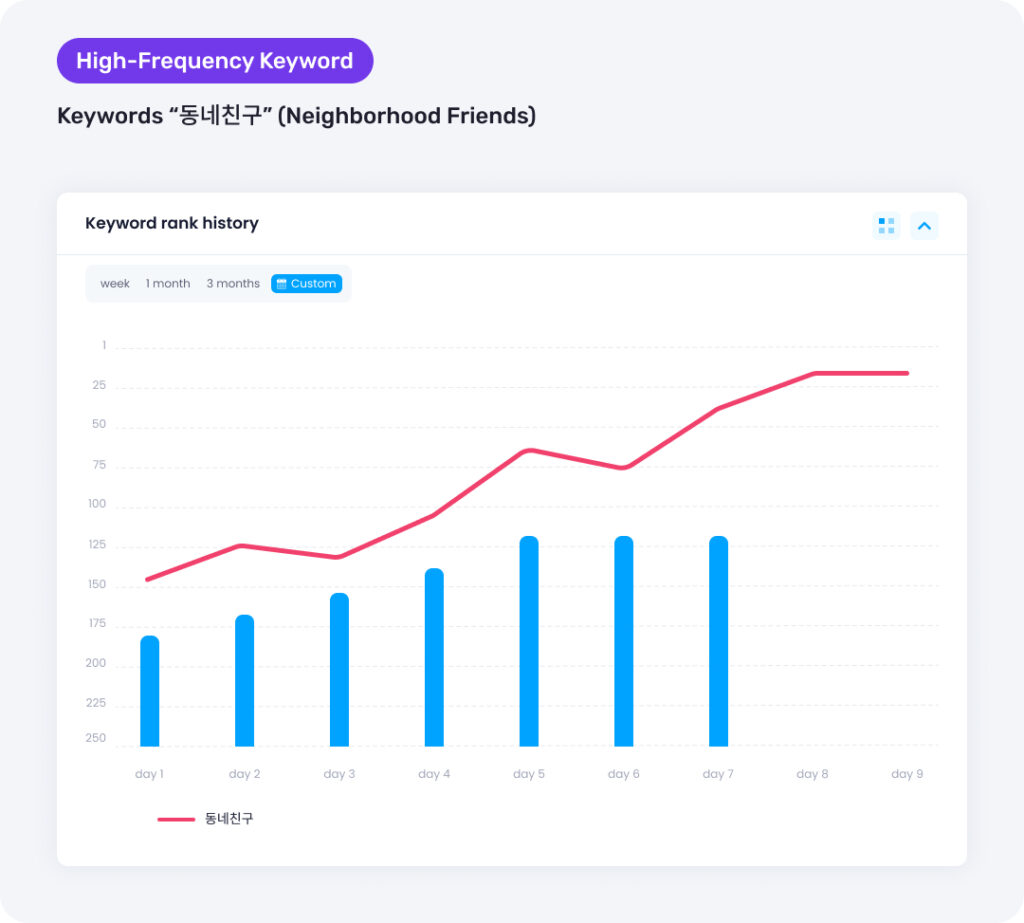

3. “Neighborhood Friends” (동네친구). The final challenge was the category leader. This is a high-volume keyword with very strong competitors. Our starting rank was #148, which meant the app effectively had zero organic weight.

On the first two days, we launched 60 to 90 installs daily to jump out of the “invisible” zone and into the Top 100. We quickly scaled this volume up. By days 3 and 4, we increased the daily installs to between 130 and 170. The specific objective here was to break into the Top 50. For the final push on days 5 through 7, we maintained 210 installs per day.

The strategy delivered a massive shift. The app skyrocketed from #148 to Rank #14. While we haven’t hit #1 yet, securing a spot on the first page for the most popular keyword in the niche is a game-changer for organic visibility.

Results and Strategic Analysis

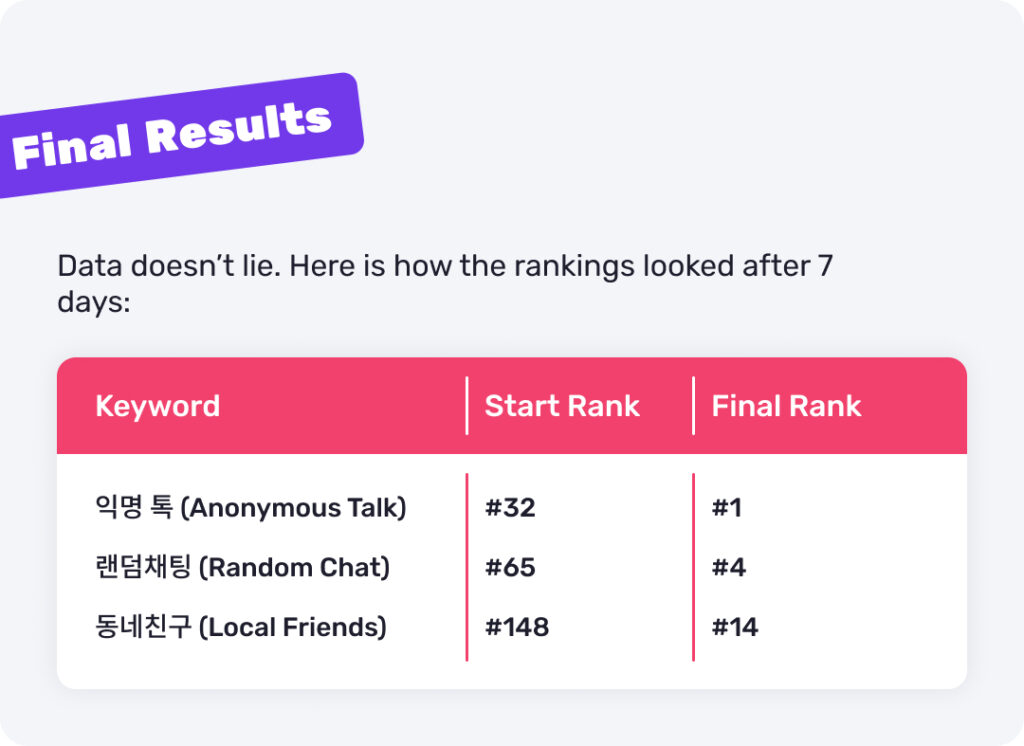

The campaign concluded with the app holding dominant positions across all three targeted keyword tiers.

Anonymous Talk (익명 톡): This niche keyword saw the most definitive victory. The app climbed 31 positions, moving from Rank #32 directly to Rank #1.

Random Chat (랜덤채팅): High-intent users are now finding the app easily. We achieved a growth of 61 positions, rising from Rank #65 to a top-tier Rank #4.

Neighborhood Friends (동네친구): The most competitive keyword saw the largest volume of growth. The app gained 134 positions, jumping from an invisible Rank #148 to a highly visible Rank #14.

Beyond the raw ranking improvements, this case study revealed three critical insights for developers targeting the South Korean market.

Insight 1: Localization Drives Conversion.

The most significant metric observed was not just the ranking, but the Organic Conversion Rate (CVR). Once the app reached Rank #1 for “Anonymous Talk” and Rank #4 for “Random Chat,” the organic CVR increased by 22%.

This validates the hypothesis that “Native” keywords create trust. When a user searches for a slang term like dongnae-chingu (Neighborhood Friend) and sees that exact term reflected in the app’s title and screenshots, the psychological friction of downloading is removed. They feel the app is “for them,” not a generic foreign import.

Insight 2: The Importance of Review Management.

Reaching Rank #14 for the main keyword brought visibility, but it also exposed the app to scrutiny. South Korean users are meticulous researchers. According to consumer reports, they are more likely to read reviews than users in the US or EU.

As the app climbed the charts, we advised the client to implement a reputation management strategy. High rankings bring traffic, but a 4.5+ star rating is required to convert that traffic. Moving forward, the strategy involves pairing keyword installs with high-quality native reviews to ensure the retention of these new positions.

Insight 3: Velocity Matters More Than Total Volume.

The success of the “Neighborhood Friends” keyword (from #148 to #14) proves that the trend of growth is more important to the Google Play algorithm than the total number of downloads. By increasing the daily installs from 60 to 210 over seven days, we showed the algorithm a curve of accelerating popularity. This signals “trending” status, which prompts the store to rank the app higher to test its quality with organic users.

Conclusion

This case study demonstrates that social apps, despite the dominance of local giants, can achieve rapid visibility in South Korea through native-first localization. The keys to success involve bypassing standard dictionary translations to use actual slang, selecting keywords based on specific user intent, and implementing keyword installs campaigns that signal relevance to the algorithm.

At Keyapp, we specialize in helping international developers unlock Tier-1 Asian markets. Our methodology combines cultural market analysis with proven promotional strategies, ensuring your app builds the necessary authority to convert local users and sustain high organic rankings.

Ready to speak the local language of growth? Contact Keyapp’s expert team to develop a customized app promotion strategy that establishes your app as a top choice in the region.